A coffee on the way to work, an online impulse buy, or an unused subscription—small expenses add up faster than most realise. By the end of the month, the paycheck often seems to have vanished without explanation. This is where a money tracking app changes everything. Instead of vague guesses, these apps provide real-time insight into spending, helping people manage finances with clarity and confidence.

Which App Is Best For Keeping Money?

The big question many ask is, “Which app is best for keeping money?” The answer depends on lifestyle and personal goals. Some people prefer apps that emphasise long-term savings, while others need quick reminders about daily expenses.

The most effective money tools are those that balance automation with simplicity. They should track expenses without constant manual updates, provide alerts when spending rises, and help build better financial habits.

Why A Money Tracking App Matters More Than Ever

Modern spending is seamless—tap, click, or swipe. While convenient, this frictionless system makes it harder to notice overspending. A money tracking app solves this by showing every transaction in context.

Instead of wondering where the money went, users can see patterns like:

- High food delivery spending each week.

- Multiple streaming subscriptions are rarely used.

- Seasonal expenses, such as holiday shopping, repeat annually.

As The Guardian notes, awareness is the first step toward better money management. Once habits are visible, adjusting them becomes easier.

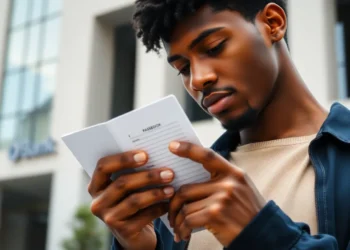

Real-Life Example: From Stress To Stability

Consider a young graduate working their first full-time job. Despite earning a decent salary, they constantly feel broke. After downloading a money tracker-expense & budget tool, they discover that frequent ride-hailing trips and eating out drain nearly 40% of their income. By switching to public transport and cooking more meals, they free up over $250 monthly. Within a year, they save enough for a vacation and start an emergency fund.

This story mirrors many real-life experiences — when visibility improves, choices improve too.

Benefits Of Using A Money Tracker-Expense & Budget Tool

A reliable app does more than just list numbers. It:

- Encourages accountability by setting daily and monthly limits.

- Supports goal setting, like saving for a car or reducing debt.

- Minimises manual effort by automating transaction categorisation.

- Increases confidence when making financial decisions.

According to Intuit’s research, people who track spending consistently feel more in control and are better prepared for unexpected expenses.

Free Vs Paid Apps: What To Expect

Not all tools require a subscription. Many free options provide core features such as expense tracking, category tagging, and limited reporting. These are ideal for beginners who want to test the habit of tracking before investing in advanced versions.

Paid apps, however, often add premium features such as:

- Advanced analytics.

- Customizable categories.

- Savings and debt payoff planning.

- Multi-device synchronisation.

For users serious about long-term financial planning, the investment in a paid app may quickly pay off.

Security Concerns And Open Banking

Connecting bank accounts to apps may raise questions about safety. According to Which?, open banking regulations in many regions require high security standards, including encryption and user consent protocols. This means modern apps are generally safe, provided users choose reputable companies with strong data protection.

The Future Of Money Tracking Apps

The next generation of apps will likely integrate artificial intelligence, predicting spending habits and suggesting optimised budgets. Some are already experimenting with proactive alerts, such as reminding users before recurring expenses renew. The long-term vision is not just tracking but guiding users toward smarter, more automated money management.

Conclusion: Take Control With A Money Tracking App

Managing finances no longer needs to feel overwhelming. With tools like PocketGuard, Goodbudget, Mint and similar apps, everyday spending becomes transparent, and financial goals feel achievable. By turning habits into data, people can finally answer the question, “Where does my money really go?”

The real challenge is not finding the right app, but committing to using it consistently.

Have you tried a money tracking app? Did it help reduce stress or reveal surprising spending habits? Share your story—we’d love to hear how technology has shaped your financial journey.